Thank you for being a leader in Arapahoe County 4-H!

Here you will find information on required procedures of all 4-H clubs.

Interested in becoming a 4-H volunteer?

Enrollment Packet

Enrollment Confirmation – Word

Enrollment Confirmation – Excel

Eventbrite link to pay online

4-H Chartering Information

Email or mail all documents to Jean Walton

jwalton@arapahoegov.com

6934 S. Lima St., Suite B

Centennial, CO 80112

Additional Resources

Arapahoe County 4-H Policies for Success

Manual for running a successful club

Colorado 4-H Code of Conduct

Colorado 4-H Dress Code

Club Literature Request Form

4-H Online

Arapahoe County 4-H E-Newsletters

Animal Care and Housing Form

Code of Showring Ethics Form

Animal E-Records

General Project E-Records

Sample EIN Application

EIN Application

As determined by the Internal Revenue Service (IRS), 4-H Clubs and Affiliated 4-H Organizations are exempt from federal income tax under the provisions which correspond to section 501(c)(3) of the IRS Code. All 4-H clubs must submit their EIN number to the Arapahoe County Extension Office.

Send the EIN Application via mail or fax:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Share Club News

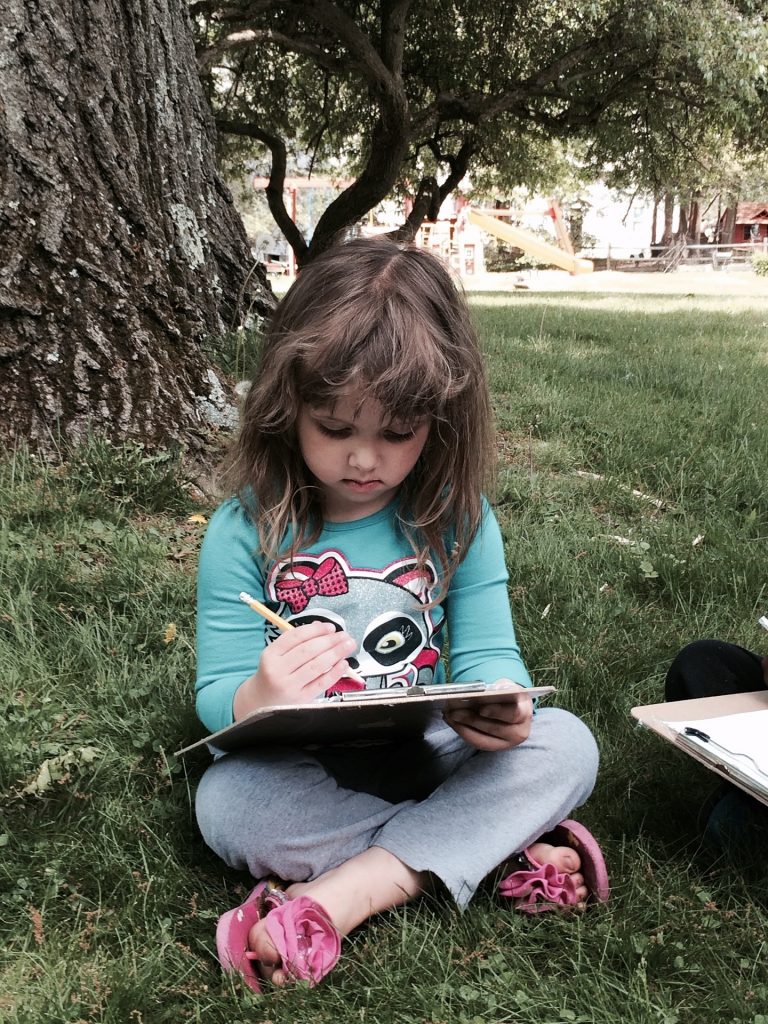

We invite leaders to submit brief stories and digital photos of club activities, along with a caption of names, for the 4-H newsletters and e-blasts. Please submit articles and ideas to Jean Walton, Office Coordinator, at jwalton@arapahoegov.com.

[youtube https://www.youtube.com/watch?v=3zAp391DtjE&w=560&h=315]